Live & Local: Prince Dykes and Councilman Darrell Watson Inspire Financial Literacy in Youth

Financial literacy is lacking generally in the U.S. It’s not taught in schools, it’s not talked about at home, and it’s usually developed in adulthood (hopefully not too late). But knowledge of financial matters is a real issue in the Black community.

To kick off Financial Literacy Month (April), financial advisor and children’s book author Prince Dykes and Denver District 9 Councilman Darrell Watson (along with Denver District 7 Councilwoman Flor Alvidrez) are hosting a children’s financial literacy event on Wednesday, April 2 at 3 p.m. at Blair-Caldwell African-American Research Library, 2401 Welton St., Denver, Colo. 80205.

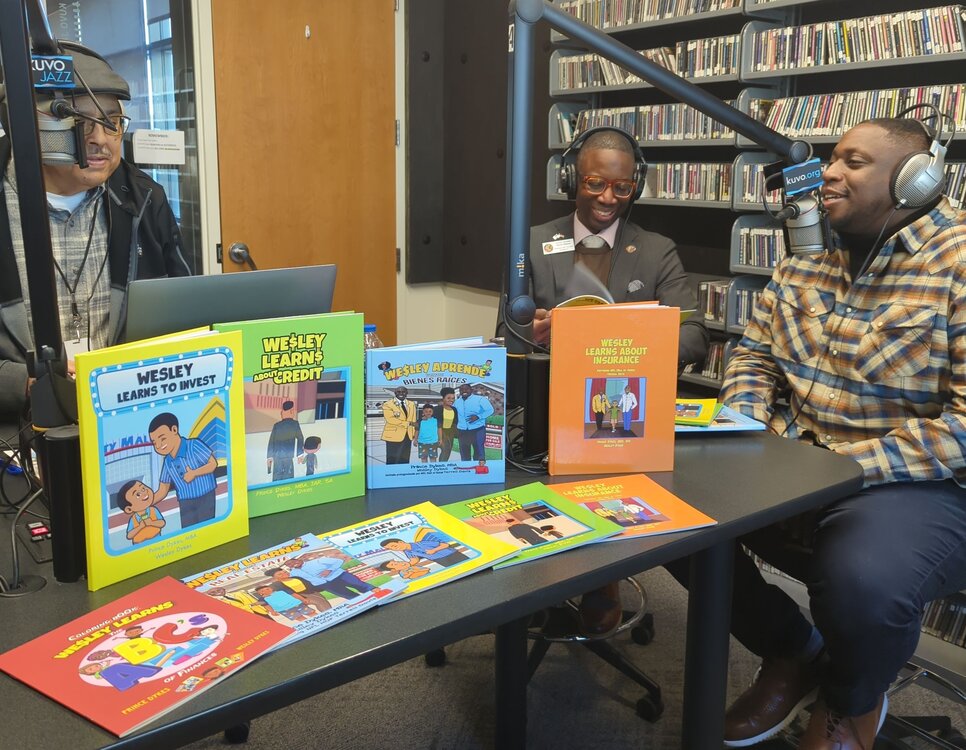

Dykes and Councilman Watson visited The Morning Set to share stories from his “Wesley” children’s books, discuss the community impact of financial decisions, and talk about the event on April 2, where they will distribute 500 books and open investment accounts for families. Food and vendors will be on-site.

The following is an excerpt of the conversation heard above:

Steve Chavis: Beautifully illustrated, really fun story. Young Wesley in this book, Wesley Learns to Invest, wants to buy a video game system. And you tell him, dad says, "Hold on son, we're not just going to buy you a video game." How many households has that happened in.. like every one of them! This is a universal (thing), the kid wants a video game system. Then you explain to Wesley, "The more GS4s that are sold, the more money the companies make. This raises the value of the investor's stock, thus earning them more money." "Wow," Wesley marveled. "How cool!" Tapping his chin. "So, if I buy stocks, I can make money?" Wesley's dad nodded. "Yes, son." The boy rubbed his hands together with anticipation. "I will be rich!" He just wanted his game system. So every family can relate to the stories of Wesley learning about investment, real estate.. It's an amazing body of work you've created here.

Prince Dykes: Thank you, thank you, thank you, thank you. Definitely didn't see this happening at the time and it just kind of flowed with it when I started when I was stationed in Hawaii, and then the military brought me here to Denver and that's where I hooked up with Terrell Davis here, Broncos legend, Denver legend. And he loved the third book. He said, let's do it. And he came with the idea of, 'Hey, how about I put you in a book and you collaborate with some boys and girls clubs?' So that's what the third book came from. Then last year we collaborated again on the fourth book for real estate, and now we just came out with the coloring book, an alphabetical coloring (book.) So, you get to learn the alphabet and you get to get the activity of coloring with the definition of financial literacy added into it in English and Spanish. Same thing we did on our fourth book. So, I got Wesley worked in on this. Now he's coloring every day, every day! And so yes, I just think it's a good thing so we can even talk to the kids at an even younger age because my belief is we got to start at the youngest age possible because so many people, we ask how did we get to this point? And the industry is geared around repair. In the financial industry, and Mr. Watson can attest to this, is the only industry where you have to educate somebody before you even can think about selling them anything. Everybody knows what the radio station does, right? Everybody knows what the mechanic does, or the barber does, but nobody knows what a financial advisor is or what investing is. Life insurance, real estate, credit insurance, all these things. and we come from the wealthiest country in the world.

SC: Stories to tell. Swing the microphone over to Councilman Watson, who with District 7 Councilwoman Alvidrez decided this upcoming event on April 2 is an important event for your constituents. Why is that?

Councilman Darrell Watson: I got to say thank you for welcoming me to KUVO as well. I live right up the street! Since 87, I've been on the east side.

SC: ..and not every district has a radio station!

CmlmDW: Not every district has KUVO, not just a radio station! So, thank y'all for having me. I got to tell you, I've had a 30-year career in finance, and when my brother, next to me here, brought this book forward, demonstrating financial literacy for our youngest people and making sure that our youth understand financial literacy, I just exploded! So, it was a no-brainer to bring this event, not just this year, but every year that I have the ability to bring it, to make sure we have it at Blair Caldwell Library on April 2.

Carlos Lando: There's an old saying, and it's not how much money you make or you're making when you first make money, a little bit of money? You just think, 'oh man, this is great!' It's about how much you keep or how much you invest. Sometimes you read about people who have a lot, how did that go broke? That guy had all kinds of money! You know what I mean?

PD: And the thing (is), it happens so fast! So, you look at our entertainers or athletes, they take the elevator to the top. Versus a lot of businessmen, somebody like a Warren Buffet, they take the stairs. So by the time they get to that point, it's been 10, 20, 30 years, they've been up, they've been down, they understand things. The network has changed. The people they're around has changed and they're more astute for that position versus someone who takes the elevator to the top, who gets it so fast. And especially when around you, your environment didn't even have a chance to change. And one thing I want to add too on that event, we're looking to start kids with their first investment accounts.

CL: So, the event is for all ages though, right? Parents can learn as well.

PD: One of the things that we've struggled with the most is that the kids can't get the stocks unless the parents open up a brokerage account for them. So, a lot of parents sometimes are like, 'Well, what is a broker account? What is this? Where do I go? How do I do this?" And some are not comfortable.. So that's what another, I guess, point of entry (is). We know when you do something like this, you're going to have your choke points of where you're going to have to overcome (things). But that's one of our battles. So, we have to get the parents involved because in order to have, for a kid to have a custodian account, the parents have to get involved to open an account for 'em.

SC: Councilman, let me ask you to cast a little vision here. You're right in the right now, and now you're dealing with today's issues, but you're thinking a little forward. What would happen to a community if community-wide people understood investing, financial literacy, the benefits of real estate? How would District 9 change? What's the long-term view here?

CmlmDW: I got to tell you, someone who's spent their entire life, I was born a youngest of seven in the projects in the Virgin Islands, knew what poverty is and was. But I understood from a very young age how I was going to, as the youngest of seven, bring my family out of that poverty, it was to understand that money. My mother was brilliant, is brilliant - she still lives here in Five Points. I could not understand why we were so poor. And the money is what I knew we needed to know. And that's why when I went to school, graduated, had a successful career in finance. I knew that was the key. Purchasing that first home in Whittier, '97 for $75,000 and then sold it for over $200,000. Used that equity to help my brother in Atlanta buy a place, my sister in New York, she's now in Virginia. We spread that equity, breaking the chain of that circular, historic generational poverty that our family was in. So, you asked me the magic wand question: If we had financial literacy in D-9, what would be the difference? I think sometimes our story missed the piece that as Black people, we have agency. We have the ability to lead our own future. A lot of it is talking about repair or reparations - that still needs to occur. But if Black folks actually understood the power of the dollar, holding on to grandma's house instead of selling it when she dies, having a living will and having insurance, working with your brothers and sisters or your grandkids, usually what happens in Whittier-Cole or Five Points, and spreading that money across the neighborhoods, we could end gentrification. We could end displacement - not expecting simply for the city to have affordable housing programs, but we as a community demonstrating agency from A to Z, knowing the power of our spending and what we can do. I think this is a powerful book, my brother, series of books. And I think this is the way we as a people lead our path demonstrating our agency and our ownership of our future.

LINKS:

Global Childrens Financial Literacy Foundation

Catch “Live & Local” every Tuesday & Thursday on KUVO. Tune in to KUVO JAZZ 89.3 FM in Denver and listen to The Morning Set, weekdays from 7 – 10 a.m. MT. You can stream online here at kuvo.org or listen to the KUVO app.

Stay connected to KUVO’s programs and our community! Sign up for the Oasis E-News today!